BitMEX advanced trading features tutorial

Margin trading is not suitable for beginners in trading and should be done with careful caution and attention. Someone using the information provided in this video or article, including buying or selling, does it on his or her own risk.

Bitmex allows margin trading of Bitcoin and crypto futures (altcoins). If you are familiar with the basic features that Bitmex platform offers, you may find the following advanced features useful for your trades. Before we begin you have to have a BitMEX trading account. Using the link here to register gives you a 10 percent discount on transaction fees for the first six months.

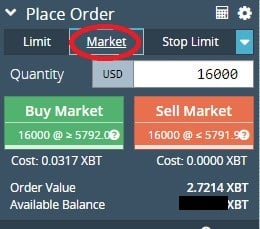

Starting a trade immediately using ‘Market’

On the left pane – besides the option to specify a price to start a new trade, we have an option called ‘Market’ which will immediately buy or sell to the order book at the best available price. Use this if you are afraid that the market will “run away” from you but keep in mind that for large amounts it could buy or sell at a bad price (since the liquidity isn’t sophisticated enough to fill your large amount). As a reminder, the ‘Market’ option to end the trade will be located on the order line at the right cell.

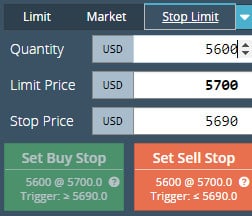

The Stop Limit or stop loss

Next to the Market option, we have the Stop Limit. This option is used to extract our order (buy/sell) only if a certain stop price is triggered. This is mainly used as a stop loss, to cut losing positions and minimize the loss.

Stop loss means – “sell on my command at a certain price if the market reaches a certain price”. Let’s say if we are starting a SHORT (SELL) of 1 BTC size ($5600) at BTC = 5600$, and we want to lose no more than 100$, then we set our stop loss to be as follows: The stop price will be 5690, the limit price will be set to 5700. This way as the price touches 5690 our command to BUY $5600 at 5700 will be triggered, which will end our position and limit our loss to around 100$.

Tips for using Stop Limit: If you short (SELL) – make sure limit price is always higher than the stop price, the opposite if you long (BUY). Also, tight stops are a good idea so you limit your loss, but keep in mind, in the volatile crypto market a position with a very close stop order can easily get terminated. You can always create a stop limit command for only part of your position.

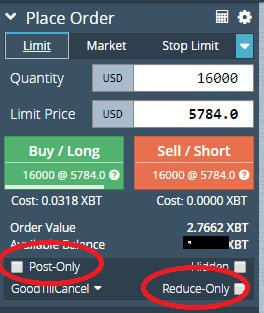

Reduce Only

If this is marked then the command will be for a reducing current position only and not opening an opposite position. For example, a LONG position of $3,000 was bought when BTC = 5100. In order to take profit, I placed 2 SELL positions, each $1500 (half), one at 5300 and the other at 5500. I also placed a stop loss of $3000 at 5050. Let’s say the Bitcoin had gone down and triggered our stoplosss at $5050 and from there went back up and encountered our commands at $5300 and $5500 – hence, if we didn’t use Reduce Only then a SHORT positions would have been opened at $5300 and $5500. This is not what we were trying to do as it was meant only to take profit from our LONG position (reduce that position in other words).

Post Only

This means we only post commands to the order book and we don’t buy from existing commands. This is mainly used by robots and algo-traders. In order to always pay the maker fee and not the taker’s (reminder: maker is the one who creates the command, taker buys from an existing command. The maker’s fee will usually be cheaper than taker’s).

Time in force to extract orders

Three options for giving time to your new order: Good Till Cancel, Immediate or Cancel – what is unfilled immediately is cancelled. The third option is Fill or Kill – This option is also used mainly by robotic trading. This means – if there is not enough volume to extract the whole command, then do not extract at all. It’s basically all or nothing.

Cross Margin Level

Leaving the margin bar on Cross means: “use all the available balance in our account as collateral for our trading”. If you have enough funds on Bitmex I would suggest using this option and not at a very-high margin level. This way your position will not get liquidated at some point. The disadvantage, in this option unless you’re using stop-loss, is that your loss is not limited or limited to the available balance on your account and not just to your position’s used balance.

You can always change your margin level of a running position. You will see the effect on the liquidation price, which would change accordingly.

A tip about liquidation… The liquidation price is related to the index price that Bitmex is using (50% Bitstamp + 50% GDAX Bitcoin price). This is important since the list price is sometimes different from the index price.

A tip about Unrealized PNL – As explained in our previous session, the Unrealized PNL is related according to the Mark Price. If we want to see our Unrealized PNL according to the market updated price we need to hover on the Unrealized PNL and then it will appear.

Managing more than one position

For advanced traders, Bitmex doesn’t allow the running of two corresponding positions, each to a different direction. Let’s say we would like to apply a trading strategy and to open one 10x margin short and one 10x margin long (This idea could be used in days of decisions that would carry strong movement in either direction – like the SEC decision about the Winklevoss twins’ ETF). This can only be done from two different accounts. Also, Bitmex doesn’t allow two positions to run in the same direction. It will update the margin and position size if you add to your current position.

Funding rates, or fee calculation of Bitmex

Bitmex uses a different strategy to calculate the fees traders pay. When the fee is displayed in red – the LONG positions will pay the fees (since there are more LONG positions than SHORT), and the short positions will earn this fee, which is updated every 8 hours. When the fee is displayed in green – the LONG positions get the fee. If you hover with the mouse you will see predicted funding rate for the next 8 hours.

The Bitmex Options or Futures markets

Bitmex issues futures with dates of the end of each quarter of the year (March, June, September, and December).

The option represents the price of the asset at the end of the current quarter. This kind of trading is more speculative, and as you may notice – the volume is sometimes very low, which creates very low liquidity. At the end of the quarter the options expire at a given price (Settlement price), if you are holding the option you will get paid the difference between your buying price and the settlement price. More info about the futures can be found here. This can be used in order to apply trading strategies like spreads.

Sometimes there are Binary options available on Bitmex. The option is regarding major issues in the crypto world. For example – if SegWit is implemented, if the ETF is approved, etc. The price represents the probability the event will take place. Let’s say if the price of the option of the ETF is at 30, this means there is a 30% chance of approval. If ETF gets approved, then whoever bought the option at 30 will have the option made equal to 100. If the ETF gets rejected then the option will be made equal to zero.

The link here gives you a 10 percent discount on transaction fees for the first six months.