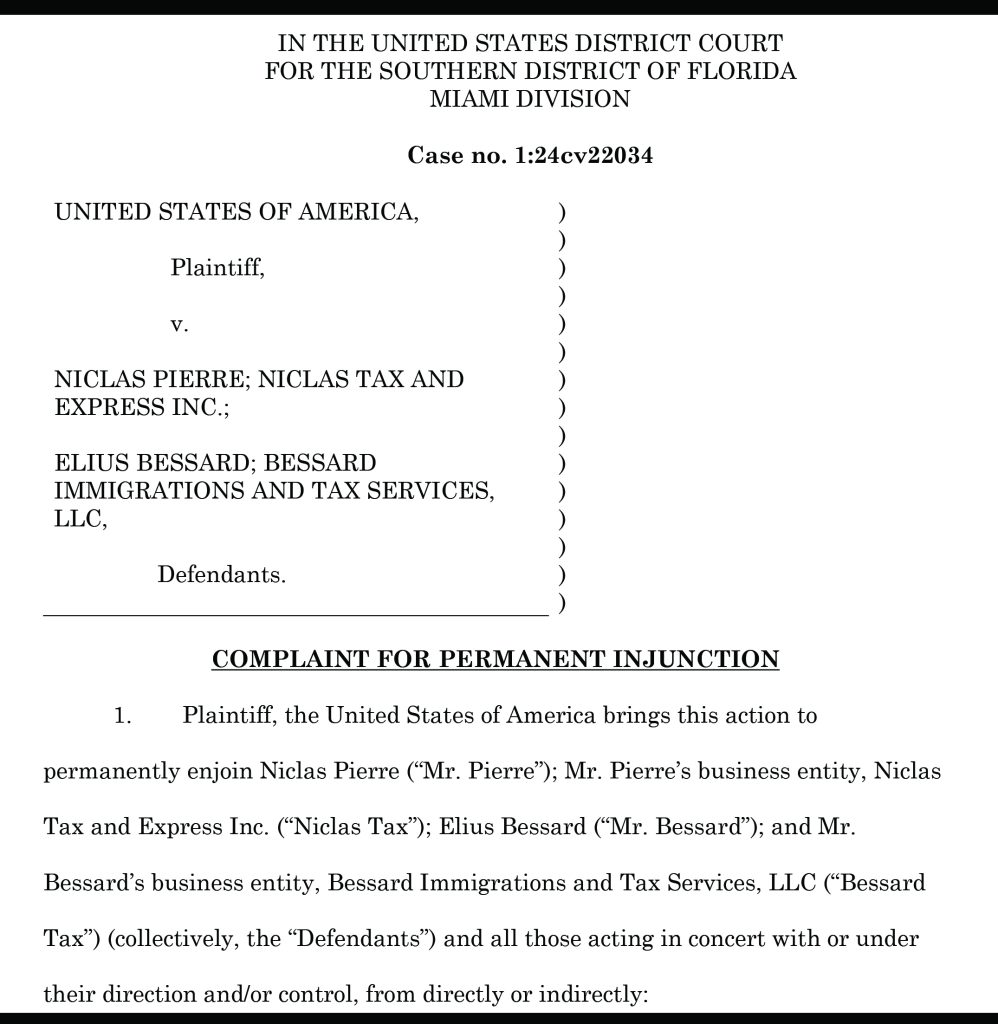

(Le Floridien) — The Justice Department’s Tax Division has taken decisive action today by filing a civil injunction suit aimed at permanently barring two prominent Haitian tax preparers, Niclas Pierre and Elius Bessard, from preparing federal tax returns for others. The suit also targets their tax return preparation businesses, Niclas Tax and Express Inc. (located at 7050 NE 2nd Ave, Miami), and Bessard Immigrations and Tax Services LLC. (located at 20511 NW 2nd Court, Miami Gardens). Additionally, the United States is seeking a court order requiring the defendants to return their fraudulently obtained preparation fees to the government.

The complaint, lodged in the U.S. District Court for the Southern District of Florida, alleges that Pierre and Bessard, through their businesses, have prepared and filed over 8,000 federal income tax returns for clients since at least 2018. According to the complaint, Pierre and Bessard employed various fraudulent schemes to claim false deductions and credits. These schemes included reporting fake or inflated business expenses, fraudulent losses from the purported sale of personal investments and business property, and falsely claiming various credits like the Residential Energy Credit and the American Opportunity Credit, all without their customers’ knowledge.

A significant aspect of the alleged fraud was the defendants’ effort to conceal their activities. The complaint states that Pierre and Bessard often did not identify themselves as the return preparers, instead listing another person or no one at all as the preparer. This deceitful practice has made it challenging to estimate the exact financial loss to the United States, but it is believed to amount to millions of dollars in lost tax revenue.

Deputy Assistant Attorney General David A. Hubbert of the Justice Department’s Tax Division announced the filing of the suit, underscoring the importance of integrity in tax preparation and the necessity of protecting taxpayers from fraudulent practices.

The attorneys from the Tax Division are handling this case, which highlights the ongoing efforts by the Justice Department to clamp down on tax fraud and protect the public from dishonest tax preparers.

This case serves as a crucial reminder for taxpayers to carefully select their tax preparers and stay informed about potential fraudulent activities in the tax preparation industry.

If convicted of preparing fraudulent income tax returns, Niclas Pierre and Elius Bessard could potentially face imprisonment. The Justice Department’s allegations against them include inflating business expenses, reporting fictitious deductions, and falsely claiming various tax credits without their clients’ knowledge. These actions have allegedly resulted in significant financial losses for the IRS. Given the severity of these charges, a conviction could lead to substantial prison sentences for both Pierre and Bessard.

Last February, Phedson Dore, of Haitian origin, was sentenced to two years in prison for conspiring to defraud the United States by preparing and filing false tax returns for clients. According to court documents and statements made in court, from 2017 through 2020, Dore and his co-conspirator operated Empire Tax Services (located at Broward Plaza -4807 FL-7, Davie, FL) and filed hundreds of false tax returns each year. Dore typically inflated federal income tax withholdings and reported fictitious itemized deductions to generate refunds for clients to which they were not entitled. To conceal his involvement in the fraud, Dore did not always list his name as the preparer on the returns or include Empire’s Electronic Filing Number (EFIN). Instead, he used his employees’ names and the EFINs of other tax preparation businesses. Dore and his co-conspirator caused the IRS a loss of approximately $970,000. Photo Amazon.com/Niclas Pierre: Digital Music