Fraud Threats Loom as Tax Season Nears in South Florida

Fort-Lauderdale, FL (LE FLORIDIEN) — As tax season looms, South Florida Haitian residents are urged to carefully vet the professionals they entrust with preparing their tax returns. The community faces a growing concern over fraudulent practices by so-called “tax preparers” who exploit their clients’ trust for personal gain.

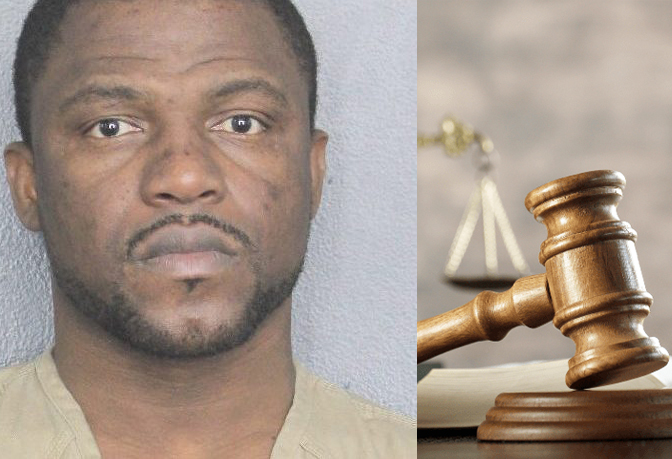

The case of Jean Volvick Moise, a 39-year-old Haitian tax preparer from Broward County, is the latest example of dishonesty within the Haitian community’s tax preparation services. Moise was sentenced this week to three years in federal prison for running a years-long scheme to file fraudulent tax returns.

Moise, President of SON’S MULTIL SERVICE, LLC, operated as a tax preparer from 2014 to 2022 and knowingly submitted hundreds of falsified tax returns between 2016 and 2022. These returns exaggerated refunds, enabling clients to receive payouts far beyond what they were entitled to. Prosecutors revealed that the total fraudulent claims exceeded half a million dollars. In exchange for his services, Moise charged clients inflated fees, further exploiting those he claimed to assist.

Jean Volvick Moise, a Broward County tax preparer recently sentenced to three years in federal prison for filing hundreds of fraudulent tax returns, used deceitful tactics to inflate refunds for his clients, court documents reveal. His fraudulent practices spanned several years and included fabricating information on tax returns, misrepresenting clients’ dependents, educational credits, and business expenses.

According to the factual proffer, Moise regularly included false Form 1099 withholdings and Schedule C business expenses—often for businesses that did not exist. In one instance, he claimed a dependent exemption for a client in 2018 despite the client having no dependents or ever indicating otherwise. He also submitted a fabricated education credit for a school the client said he did not recognize.

The client, identified in court records as F.B., had only provided Moise with a Form W-2. Moise, however, never reviewed the tax return with the client nor provided a copy. F.B., who had relied on Moise for tax preparation since 2016, paid him between $1,500 and $2,000 annually.

As part of an undercover federal investigation, Moise admitted to fabricating information to secure larger refunds. “I make things up,” he confessed, according to court filings.

Moise’s three-year federal sentence will be served consecutively to a state sentence stemming from a 2016 arrest in Broward County. He was convicted in March 2023 of unlawful sexual activity with a minor after forcing himself on a 16-year-old girl and sentenced to six years in state prison.

Until recently, Moise was held in a state prison. He was transferred to the Broward Sheriff’s Office’s Paul Rein Detention Facility in Pompano Beach on a court order and remains in custody as of the writing of this piece, according to federal and state records.

Haitian residents in South Florida need to be careful when choosing someone to prepare their taxes. It’s important to make sure the person is qualified and trustworthy. Tax laws can be complicated, and working with dishonest preparers can cause serious problems, including issues with the IRS. By checking their credentials and reviewing their tax returns, Haitian taxpayers can avoid fraud and protect their finances.